Summary

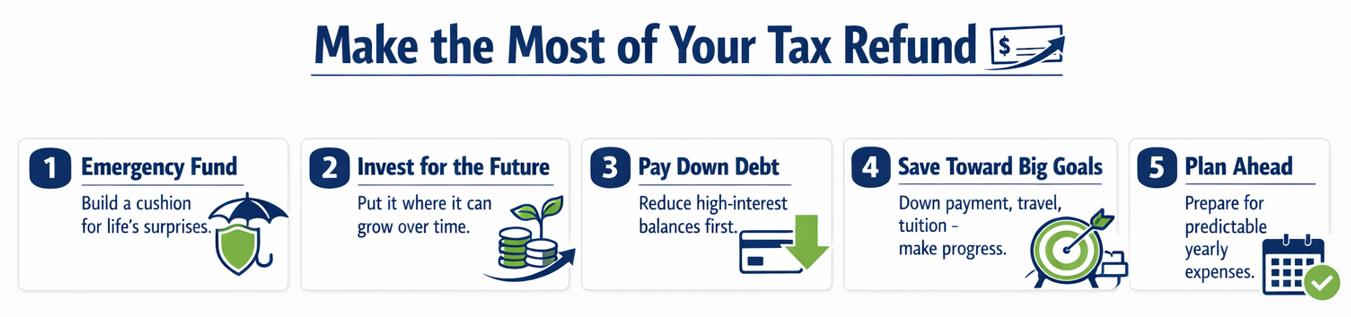

Looking for smart ways to make the most of your tax refund this season? Your refund can be more than extra cash – it can be a valuable opportunity to strengthen your financial foundation. With a little planning, your refund can help you build an emergency fund, invest for future goals, pay down high-interest credit card debt, save for big milestones and stay ahead of predictable expenses.

And once you’ve prioritized how to use your refund, consider taking an extra step to help your money grow even faster: depositing it into a high-interest, FDIC-insured* Personal Money Market account from First Internet Bank. It’s a simple way to earn more on your savings while keeping your money accessible.

Smart Ways to Put Your Tax Refund to Work

Tax season brings more than paperwork – it can bring financial opportunity. If you are fortunate to receive a refund, it can be a powerful tool for strengthening your financial foundation and fueling your future goals. Instead of letting it sit idle (or spending it too quickly), consider putting it to work in ways that help your money grow

1. Build or Strengthen Your Emergency Fund

Life’s surprises – like a flat tire on the way to work, an unexpected trip to the emergency room or even a sudden change in employment – can quickly derail your budget. A strong emergency fund helps cushion those unexpected moments. While experts often recommend saving three to six months’ worth of living expenses, getting there takes time. Using your tax refund as a jump-start can accelerate your progress and give you greater peace of mind.

2. Invest for the Future

Your refund is the perfect starting point for building long-term financial security. Whether you’re saving for upcoming expenses or planning ahead for major milestones, choosing an account that earns interest ensures your money continues to grow over time.

3. Pay Down Debt

If you’re carrying high-interest credit card debt or loan balances, you know how quickly those charges can pile up – sometimes feeling like an avalanche that becomes harder to stop the longer it builds. Using your tax refund to pay down that debt is one of the smartest financial moves you can make. Reducing what you owe frees up future income, lowers stress and helps improve your overall financial health.

4. Save Toward Big Goals

Dreaming of a down payment for a new house? A well-earned vacation to Italy? Or maybe you’re thinking ahead about education expenses – whether that means setting aside money for future tuition costs or even starting a college fund for your little ones? Your tax refund can provide the boost you need to turn big goals into achievable realities. Setting funds aside now helps you stay motivated and focused.

5. Plan Ahead for Upcoming Expenses

From annual insurance premiums to back-to-school costs or holiday spending, predictable expenses have a way of sneaking up before you know it. Setting aside part of your refund for these known but irregular costs can make the rest of the year feel much smoother – and help you stay on track.

Your tax refund is a chance to strengthen your finances today while setting yourself up for a more confident tomorrow. Before spending it, take a moment to prioritize your needs and goals so you can make the most of every dollar.

And if you’re ready to make your money work harder, consider opening a First Internet Bank FDIC-insured* Personal Money Market account. By depositing your refund directly into a high-interest account, you can earn more on savings and start building momentum toward what matters most. It’s a simple step that can turn your refund into long-term growth.

Apply for your Personal Money Market today at firstib.com.

*Deposits are FDIC insured up to $250,000 per depositor for each account ownership category. To learn more, visit www.fdic.gov.